A) consignment.

B) installment sale.

C) assignment for the benefit of creditors.

D) product financing arrangement.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a period of rising prices, the inventory method which tends to give the highest reported net income is

A) moving-average.

B) first-in, first-out.

C) specific identification.

D) weighted-average.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

In all cases when FIFO is used, the cost of goods sold would be the same whether a perpetual or periodic system is used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true regarding the use of LIFO for inventory valuation?

A) If LIFO is used for external financial reporting, then it must also be used for internal reports.

B) For purposes of external financial reporting, LIFO may not be used with the lower-of-cost-or-net realizable value approach.

C) If LIFO is used for external financial reporting, then it cannot be used for tax purposes.

D) None of these.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How might a company obtain a price index in order to apply dollar-value LIFO?

A) Calculate an index based on recent inventory purchases.

B) Use a general price level index published by the government.

C) Use a price index prepared by an industry group.

D) All of the above.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a period cost?

A) Labor costs.

B) Freight in.

C) Production costs.

D) Selling costs.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming no beginning inventory, what can be said about the trend of inventory prices if cost of goods sold computed when inventory is valued using the FIFO method exceeds cost of goods sold when inventory is valued using the average cost method?

A) Prices decreased.

B) Prices remained unchanged.

C) Prices increased.

D) Price trend cannot be determined from information given.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

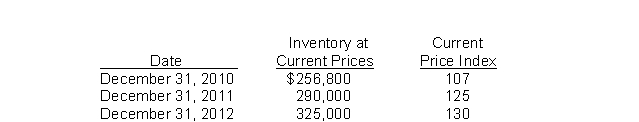

What is the cost of the ending inventory at December 31, 2012 under dollar-value LIFO?

A) $256,240.

B) $254,800.

C) $250,000.

D) $263,400.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

June Corp.sells one product and uses a perpetual inventory system.The beginning inventory consisted of 10 units that cost $20 per unit.During the current month, the company purchased 60 units at $20 each.Sales during the month totaled 45 units for $43 each.What is the number of units in the ending inventory?

A) 10 units.

B) 15 units.

C) 25 units.

D) 70 units.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Interest costs incurred to manufacture large quantities of inventory that are produced routinely should be capitalized.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions. Winsor Co.records purchases at net amounts.On May 5 Winsor purchased merchandise on account, $16,000, terms 2\10, n\30.Winsor returned $1,200 of the May 5 purchase and received credit on account.At May 31 the balance had not been paid. -By how much should the account payable be adjusted on May 31?

A) $0.

B) $344.

C) $320.

D) $296.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

Gross Corporation adopted the dollar-value LIFO method of inventory valuation on December 31, 2009.Its inventory at that date was $220,000 and the relevant price index was 100.Information regarding inventory for subsequent years is as follows:  -What is the cost of the ending inventory at December 31, 2011 under dollar-value LIFO?

-What is the cost of the ending inventory at December 31, 2011 under dollar-value LIFO?

A) $232,000.

B) $231,400.

C) $232,840.

D) $240,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

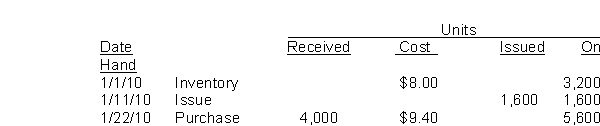

Groh Co.recorded the following data pertaining to raw material X during January 2010:  The moving-average unit cost of X inventory at January 31, 2010 is

The moving-average unit cost of X inventory at January 31, 2010 is

A) $8.70.

B) $8.85.

C) $9.00.

D) $9.40.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Homes 4 You builds single-family homes throughout the United States and Europe.The International Accounting Standards Board (IASB) Requires Homes 4 You to use which of the following cost flow assumptions for its inventory?

A) FIFO (first-in, first-out) .

B) Specific identification.

C) Weighted-average.

D) The IASB allows any of these cost flow assumptions as long as the company uses it consistently.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

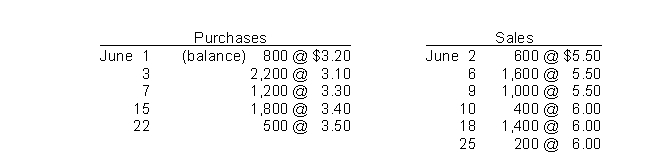

Use the following information for questions.

Transactions for the month of June were:  -Assuming that perpetual inventory records are kept in units only, the ending inventory on an average-cost basis, rounded to the nearest dollar, is

-Assuming that perpetual inventory records are kept in units only, the ending inventory on an average-cost basis, rounded to the nearest dollar, is

A) $4,096.

B) $4,238.

C) $4,290.

D) $4,322.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Use of LIFO provides a tax benefit in an industry where unit costs tend to decrease as production increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nichols Company had 400 units of "Dink" in its inventory at a cost of $6 each.It purchased 600 more units of "Dink" at a cost of $9 each.Nichols then sold 700 units at a selling price of $15 each.The LIFO liquidation overstated normal gross profit by

A) $ -0-

B) $300.

C) $600.

D) $900.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The use of a Purchase Discounts account implies that the recorded cost of a purchased inventory item is its

A) invoice price.

B) invoice price plus any purchase discount lost.

C) invoice price less the purchase discount taken.

D) invoice price less the purchase discount allowable whether taken or not.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Oats Company offers a trade discount to its customers as a reward for large orders.According to the International Accounting Standards Board (IASB) how should the customers of Oats Company account for these trade discounts?

A) As an expense.

B) As a revenue.

C) As a reduction in the cost of inventory.

D) The IASB allows any of these treatments so long as the company applies it consistently.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A manufacturing concern would report the cost of units only partially processed as inventory in the statement of financial position.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 136

Related Exams