A) endogenous,underestimate

B) endogenous,overestimate

C) exogenous,underestimate

D) exogenous,overestimate

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetary policy will have a large income effect provided the

A) IS curve is flat.

B) LM curve is steep.

C) IS curve is steep.

D) LM curve is flat.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Crowding-out" occurs in the IS-LM model as rising government spending requires a ________ in the interest rate in order to ________ the demand for money at the new equilibrium,thus ________ planned private investment.

A) rise,keep constant,lowering

B) rise,raise,lowering

C) rise,lower,raising

D) fall,keep constant,raising

E) fall,raise,lowering

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If spending is NOT responsive to changes in the interest rate,then

A) the Fed is "impotent."

B) tax policy is "impotent."

C) fiscal policy is "impotent."

D) the Fed is "potent."

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From an initial IS-LM equilibrium with a normally-sloped IS curve and a vertical LM curve,the money supply increases.A the new IS-LM equilibrium we have

A) higher income and a lower interest rate.

B) higher income and an unchanged interest rate.

C) an unchanged income and a lower interest rate.

D) lower income and an unchanged interest rate.

E) an unchanged income and a higher interest rate.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

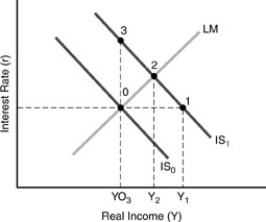

Figure 4-6

-In Figure 4-6 above,with IS₀ shifting to IS₁ against the upward-sloping LM curve,crowding-out is the result that

-In Figure 4-6 above,with IS₀ shifting to IS₁ against the upward-sloping LM curve,crowding-out is the result that

A) income stays at YO₃.

B) income rises to Y₁ instead of to Y₂.

C) income rises to Y₁ instead of staying at YO₃.

D) income rises to Y₂ instead of to Y₁.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money is assumed to earn

A) no interest at all,being just currency in hand.

B) in checkable deposit form a rate below "the interest rate."

C) in checkable deposit form a rate equal to "the interest rate."

D) in checkable deposit form a rate above "the interest rate."

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that banks pay 4 percent interest on checking accounts while U.S.Savings Bonds pay 6 percent interest.Under these conditions

A) no nonmonetary assets are willingly held.

B) a combination of money and nonmonetary assets are willingly held.

C) no money balances are willingly held.

D) we do not have sufficient information to tell whether or not any money balances are willingly held.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in transfer payments would have the same short run effect on the government deficit as an equal

A) increase in government expenditures.

B) reduction in taxes.

C) increase in taxes.

D) Both A and B.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "crowding-out" effect refers to the fact that

A) fiscal policy cannot be used to shift the IS curve.

B) rising interest rates tend to accompany an expansionary fiscal policy.

C) there may be a liquidity trap.

D) All of these.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Real money balances" refers to

A) the currency part of the total money supply.

B) the money supply divided by the price level.

C) the money supply times one minus the interest rate.

D) the non-interest-earning part of the money supply.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

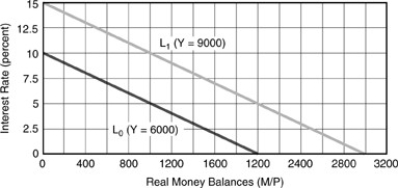

Figure 4-1

-Employing Figure 4-1 above,if Y increases by 3000 and the interest rate is fixed at 5% then the sensitivity of real money balances to changes in real income is

-Employing Figure 4-1 above,if Y increases by 3000 and the interest rate is fixed at 5% then the sensitivity of real money balances to changes in real income is

A) 0.67.

B) 0.33.

C) -0.67.

D) -0.33.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the recession phase of the business cycle,households become pessimistic about their future earning capacity as do banks.Nominal interest rates fall during recessions.Mortgage lending could be expected to

A) rise if the change in future earnings is thought to be greater than the change in interest payments.

B) stay the same.

C) fall.

D) fall if the change in future earnings is thought to be greater than the change in interest payments.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fiscal-policy multiplier will be greater

A) the greater is the interest responsiveness of the demand for money.

B) the smaller is the interest responsiveness of autonomous expenditures.

C) the smaller is the income responsiveness of the demand for money.

D) All of the above tend to make the fiscal-policy multiplier greater.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the demand for money depends only on real income,the resulting ________ LM curve causes fiscal policy to have a ________ effect on income.

A) vertical,very strong

B) vertical,zero

C) horizontal,very strong

D) horizontal,zero

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At all points below the current LM curve,

A) the supply of output exceeds output demand.

B) the supply of output falls short of output demand.

C) the supply of money falls short of money demand.

D) the supply of money exceeds money demand.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "velocity" of money is

A) the ratio of real GDP to the real money supply.

B) the real money supply divided by the real GDP.

C) the money supply divided by the price level.

D) the money supply multiplied by the price level.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

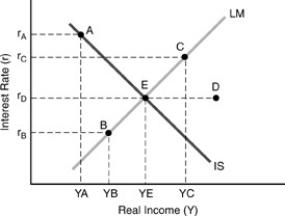

Figure 4-5

-In Figure 4-5 above,the money market is in equilibrium

-In Figure 4-5 above,the money market is in equilibrium

A) at points B,C,and E.

B) at points A and E.

C) only at point E.

D) at points E and D.

E) at points A,B,E,and C.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Y = 4,000 and we are at a point on the money demand schedule where (M/P) = 600.Should Y rise to 4,200,the same quantity of real money balances

A) will not be demanded under any conditions.

B) will be demanded again provided the interest rate does not change.

C) will be demanded again provided the interest rate rises by a certain amount.

D) will be demanded again provided the interest rate falls by a certain amount.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The practice of "monetizing the debt" is traditionally feared because it is thought to cause

A) unemployment.

B) inflation.

C) a falling price level.

D) a liquidity trap.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 148

Related Exams