A) Internal rate of return

B) Profitability index

C) Net present value

D) Modified internal rate of return

E) Average accounting return

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following methods of analysis ignores the time value of money?

A) Net present value

B) Internal rate of return

C) Discounted cash flow analysis

D) Payback

E) Profitability index

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

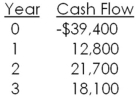

What is the net present value of a project with the following cash flows if the discount rate is 15 percent?

A) $39.80

B) $42.97

C) $44.16

D) $48.21

E) $48.30

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

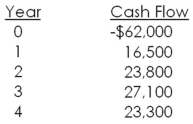

Empire Industries is considering adding a new product to its lineup.This product is expected to generate sales for four years after which time the product will be discontinued.What is the project's net present value if the firm wants to earn a 13 percent rate of return?

A) $3,505.52

B) $3,767.24

C) $4,312.65

D) $4,519.58

E) $4,902.71

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary has just been asked to analyze an investment to determine if it is acceptable.Unfortunately,she is not being given sufficient time to analyze the project using various methods.She must select one method of analysis and provide an answer based solely on that method.Which method do you suggest she use in this situation?

A) Internal rate of return

B) Payback

C) Average accounting rate of return

D) Net present value

E) Profitability index

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Steel Factory is considering a project that will produce annual cash flows of $36,800,$45,500,$56,200,and $21,800 over the next four years,respectively.What is the internal rate of return if the initial cost of the project is $135,000?

A) 7.56 percent

B) 9.19 percent

C) 11.28 percent

D) 12.24 percent

E) 12.83 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Greenbriar Cotton Mill is spending $330,000 to update its facility.The company estimates that this investment will improve its cash inflows by $56,500 a year for 10 years.What is the payback period?

A) 4.03 years

B) 4.95 years

C) 5.48 years

D) 5.84 years

E) The project never pays back.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payback method of analysis ignores which one of the following?

A) Initial cost of an investment

B) Arbitrary cutoff point

C) Cash flow direction

D) Time value of money

E) Timing of each cash inflow

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

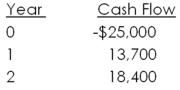

Joe and Rich are both considering investing in a project with the following cash flows.Joe is content earning a 9 percent return,but Rich desires a return of 16 percent.Who,if either,should accept this project?

A) Joe, but not Rich

B) Rich, but not Joe

C) Neither Joe nor Rich

D) Both Joe and Rich

E) Joe, and possibly Rich, who will be neutral on this decision as his net present value will equal zero

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

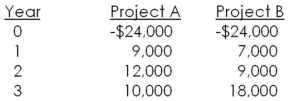

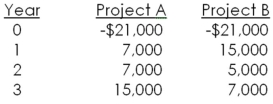

You are considering the following two mutually exclusive projects.The required return on each project is 14 percent.Which project should you accept and what is the best reason for that decision?

A) Project A, because it pays back faster

B) Project A, because it has the higher profitability index

C) Project B, because it has the higher profitability index

D) Project A, because it has the higher net present value

E) Project B, because it has the higher net present value

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Woodcrafters requires an average accounting return (AAR) of at least 17 percent on all fixed asset purchases.Currently,it is considering some new equipment costing $178,000.This equipment will have a four-year life over which time it will be depreciated on a straight-line basis to a zero book value.The annual net income from this equipment is estimated at $10,100,$10,300,$17,900,and $19,600 for the four years.Should this purchase occur based on the accounting rate of return? Why or why not?

A) Yes, because the AAR is less than 17 percent

B) Yes, because the AAR is equal to 17 percent

C) Yes, because the AAR is greater than 17 percent

D) No, because the AAR is less than 17 percent

E) No, because the AAR is greater than 17 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

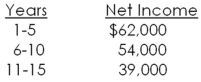

The Nifty Fifty is considering opening a new store at a start-up cost of $720,000.The initial investment will be depreciated straight-line to zero over the 15-year life of the project.What is the average accounting rate of return?

A) 13.05 percent

B) 13.68 percent

C) 14.01 percent

D) 14.18 percent

E) 14.35 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are using a net present value profile to compare Project A and B,which are mutually exclusive.Which one of the following statements correctly applies to the crossover point between these two?

A) The internal rate of return for Project A equals that of Project B, but generally does not equal zero.

B) The internal rate of return of each project is equal to zero.

C) The net present value of each project is equal to zero.

D) The net present value of Project A equals that of Project B, but generally does not equal zero.

E) The net present value of each project is equal to the respective project's initial cost.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

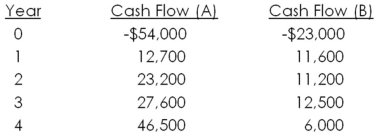

Consider the following two mutually exclusive projects:  Whichever project you choose,if any,you require a 14 percent return on your investment.If you apply the payback criterion,you will choose Project ______; if you apply the NPV criterion,you will choose Project ______; if you apply the IRR criterion,you will choose Project _____; if you choose the profitability index criterion,you will choose Project ___.Based on your first four answers,which project will you finally choose?

Whichever project you choose,if any,you require a 14 percent return on your investment.If you apply the payback criterion,you will choose Project ______; if you apply the NPV criterion,you will choose Project ______; if you apply the IRR criterion,you will choose Project _____; if you choose the profitability index criterion,you will choose Project ___.Based on your first four answers,which project will you finally choose?

A) A; B; A; A; B

B) A; A; B; B; A

C) A; A; B; B; B

D) B; A; B; A; A

E) B; A; B; B; A

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charles Henri is considering investing $36,000 in a project that is expected to provide him with cash inflows of $12,000 in each of the first two years and $18,000 for the following year.At a discount rate of zero percent this investment has a net present value of ____,but at the relevant discount rate of 17 percent the project's net present value is ____.

A) $0; -$5,739

B) $0; -$3,406

C) $6,000; -$5,739

D) $6,000; -$3,406

E) $6,000; $1,897

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

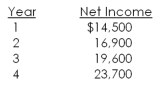

An investment has an initial cost of $300,000 and a life of four years.This investment will be depreciated by $60,000 a year and will generate the net income shown below.Should this project be accepted based on the average accounting rate of return (AAR) if the required rate is 9.5 percent? Why or why not?

A) Yes, because the AAR less than 9.5 percent

B) Yes, because the AAR is 9.5 percent

C) Yes, because the AAR is greater than 9.5 percent

D) No, because the AAR is 9.5 percent

E) No, because the AAR is greater than 9.5 percent

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

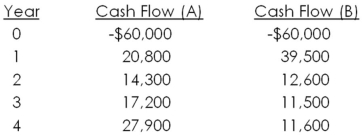

Chestnut Tree Farms has identified the following two mutually exclusive projects:  Over what range of discount rates would you choose Project A?

Over what range of discount rates would you choose Project A?

A) 8.28 percent or less

B) 8.28 percent or more

C) 9.33 percent or more

D) 9.55 percent or less

E) 9.55 percent or more

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

China Importers would like to spend $221,000 to expand its warehouse.However,the company has a loan outstanding that must be repaid in 2.5 years and thus will need the $221,000 at that time.The warehouse expansion project is expected to increase the cash inflows by $58,000 in the first year,$139,000 in the second year,and $210,000 a year for the following 2 years.Should the firm expand at this time? Why or why not?

A) Yes, because the money will be recovered in 1.69 years

B) Yes, because the money will be recovered in 1.87 years

C) Yes, because the money will be recovered in 2.11 years

D) No, because the project never pays back

E) No, because the money will not be recovered in time to repay the loan

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering the following two mutually exclusive projects.The crossover point is _____ and Project _____ should be accepted if the discount rate is 14 percent.

A) 12.79 percent; B

B) 13.28 percent; A

C) 13.28 percent; B

D) 15.96 percent; A

E) 15.96 percent; B

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is generally considered to be the best form of analysis if you have to select a single method to analyze a variety of investment opportunities?

A) Payback

B) Profitability index

C) Accounting rate of return

D) Internal rate of return

E) Net present value

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 113

Related Exams