Filters

Question type

A) $868, 000

B) $804, 000

C) $772, 000

D) $628, 000

E) None of the above

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Question 102

Multiple Choice

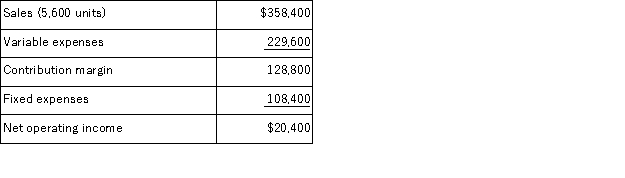

Grisham Corporation produces and sells a single product.The company has provided its contribution format income statement for February.  If the company sells 5, 700 units, its net operating income should be closest to:

If the company sells 5, 700 units, its net operating income should be closest to:

A) $20, 400

B) $22, 700

C) $20, 764

D) $26, 800

E) None of the above

F) A) and B)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Question 103

Multiple Choice

The contribution margin ratio of Baginski Corporation's only product is 53%.The company's monthly fixed expense is $617, 980 and the company's monthly target profit is $23, 000.The dollar sales to attain that target profit is closest to:

A) $1, 166, 000

B) $1, 209, 396

C) $339, 719

D) $327, 529

E) A) and D)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Question 104

Multiple Choice

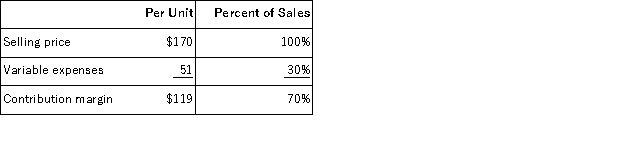

Data concerning Matsumoto Corporation's single product appear below:  Assume the company's target profit is $8, 000.The dollar sales to attain that target profit is closest to:

Assume the company's target profit is $8, 000.The dollar sales to attain that target profit is closest to:

A) $288, 800

B) $497, 378

C) $481, 333

D) $722, 000

E) A) and B)

F) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Question 105

Multiple Choice

Gilpatric Corporation produces and sells two products.In the most recent month, Product Q71M had sales of $28, 000 and variable expenses of $7, 840.Product V04P had sales of $49, 000 and variable expenses of $27, 580.The fixed expenses of the entire company were $34, 630. If the sales mix were to shift toward Product Q71M with total sales remaining constant, the overall break-even point for the entire company:

A) would increase.

B) could increase or decrease.

C) would not change.

D) would decrease.

E) A) and B)

F) C) and D)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 106

Multiple Choice

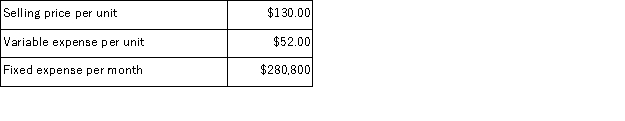

Upchurch Corporation produces and sells a single product.Data concerning that product appear below:  Assume the company's target profit is $14, 000.The dollar sales to attain that target profit is closest to:

Assume the company's target profit is $14, 000.The dollar sales to attain that target profit is closest to:

A) $326, 180

B) $593, 248

C) $494, 212

D) $959, 353

E) A) and C)

F) B) and C)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Question 107

Essay

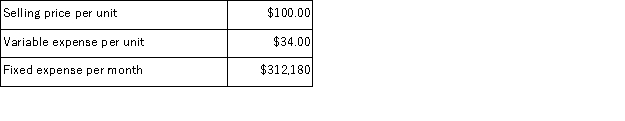

Data concerning Ulwelling Corporation's single product appear below:  Fixed expenses are $753, 000 per month.The company is currently selling 8, 000 units per month.

Required:

The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $11 per unit.In exchange, the sales staff would accept an overall decrease in their salaries of $73, 000 per month.The marketing manager predicts that introducing this sales incentive would increase monthly sales by 300 units.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Fixed expenses are $753, 000 per month.The company is currently selling 8, 000 units per month.

Required:

The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $11 per unit.In exchange, the sales staff would accept an overall decrease in their salaries of $73, 000 per month.The marketing manager predicts that introducing this sales incentive would increase monthly sales by 300 units.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Correct Answer

verified

Correct Answer

verified

Showing 181 - 187 of 187

Related Exams